Updated– 12/21/2022 – 11/7/2022 – June 19, 2022 – July 6, 2022 – April 7, 2024

Let’s Wait for Godot – The Irish Version of the Moorish Folk Believe Sidna Kdar for Betterness a Prayer on the 27th Sacred Night of Ramadan

UST’s Bitcoin Reserve Too Late in Coming to Save Dollar Peg

Andrew Busch• 3rd+Economist | Keynote Speaker | Futurist | Consultant | •

This is where #crypto is going off the rails & feels like a big ponzi scheme.

1 crypto (#terrausd) is built upon another crypto (#luna) which can be sold for other cryptos like #btc .

What investor is going to pony up $1.5B to stabilise the market when there is no central bank as a backstop?

When the world melts down and investors dump risk, investments with shaky financial backing get crushed.

Investors are indiscriminate when trying to raise cash and sell everything.

While #BTC may hang in there, the periphery cryptos will be crash tested.

Theoretically, BTC works.

Others?

TerraUSD Backers Seek $1.5 Billion to Prop Up Stablecoin

Publications by Said El Mansour Cherkaoui on Related Topics

Some of my publications related to the topic addressed by Presidente Christine Lagarde can be used as complement for my aforementioned comment while presenting the role of the World Bank and the International Monetary Fund in shaping the evolution of the World Economy with emphasis on the economies of the Southern countries. (The articles are written en Français et/and English).

Economie Mondiale en Mutation

Said El Mansour Cherkaoui – California – 15 Janvier 2021 Changing World Economy During the 1980s, the differences between non-Western countries and Third World countries became evident with regard to economic changes and progress at the level of the participation in the new industrial division of labor … Continue to read. إذا ريتا منكرن فغيره بي يديك فين لم تستطيع فغيره بي ليسانك فين لم … Continue reading

Cours et Compréhension: Monnaie et Banques

Chapitre 27 – De la monnaie et des banques On a déjà tant écrit sur la monnaie, que, dans le nombre des personnes qui s’occupent de cette matière, il n’y a guère que les gens à préjugés qui puissent en méconnaître les vrais principes. Je me bornerai donc à un aperçu rapide de quelques unes … Lire la suite

Coronavirus + Crise × Intervention de l’Etat => Circulation de Monnaie + Inflation = Chômage

COVID-19 – Coronavirus et le Besoin d’une Nouvelle Économie du Développement comme Remède National 5 – 4 = 2020 – Le 5 Mars 2020 Un Modèle Libéral Essoufflé par le Mal-Développement Durable et Ébranlé par l’absence de … Lire la suite

Said El Mansour Cherkaoui – USA 15 Janvier 2021 Sciences Po, Grenoble Institut des Hautes Etudes de l’Amérique Latine, Paris Université de la Sorbonne, Paris III During the 1980s, the differences between non-Western countries and Third World countries became evident with regard to economic changes and progress at the level of the participation in the new industrial division of labor and the implementation of industrial strategy. East … Continue reading

Débat sur la Monnaie: Economie Politique ou Politique Economique

Said El Mansour Cherkaoui 25/9/19 Oakland USA Sciences Po, Grenoble Institut des Hautes Etudes de l’Amérique Latine, Paris Université de la Sorbonne, Paris III Théorie Quantitative de la Monnaie VIEW ON THE NEW ECONOMY Vue sur la Nouvelle Economie Economie Politique ou Politique Economique MISE À JOUR LE 19 FÉVRIER 2020 Des origines lointaines Dès la … Lire la suite

Libéralisme pour le Capitalisme National et Protectionnisme pour le Commerce International

Initialement publié en October 25, 2018, 9:00 am Collection et Recueil par by Said El Mansour Cherkaoui – publié en partenariat avec le Forum MEDays. “Laissez faire!”, disaient les chantres du libéralisme au XIXème siècle. En réalité, la seule nation qui pratiquait, à cette époque, un libéralisme directement inspiré des manuels d’économie politique, était la Grande-Bretagne. … Lire la suite

Response of Said El Mansour Cherkaoui

The complexity and the various repercussions of this topic need to addressed more deeply.

First of all, I would like to have specific quotes on what you write as such and I quote you:

« Today, countries, large institutions and international companies have converted some of their money into crypto … »

In addition to giving names, I would also like to know the amounts and their end use by these countries, institutions and international companies.

Likewise, these conversions of “a portion of their money into crypto ..” are carried out and again, what are the end uses and their corresponding transactions.

These amounts in foreign currencies, they have what like guarantee and reserve of reference of their solvency at the level of the nominal value, the exchange value and the level of the convertibility value.

Regarding the reaction of legal tender of central banks and cryptocurrency, through the central bank’s controlled introduction of central cryptocurrency, within an appropriate regulatory and technical framework.

Apart from supply and demand and once again I quote you:

« Today, countries, large institutions and international companies have converted some of their money into crypto … » Do these types of transactions have the same instruments as the foreign exchange market (FX or forex) or national currencies they exchange against each other via cryptographic realizations.

Does this crypto conversion provide hedge against international currency and interest rate risks and allow them to speculate on geopolitical events and diversify their portfolios?

On the other hand in FOREX, the main players in this market are usually financial institutions such as commercial banks, central banks, fund managers and hedge funds, there is no country.

But you support and once again I quote you: “At present the countries,…. Have converted part of their cash into crypto…. So the question that arises is, how do countries stay away from FOREX and invest in crypto?

Do you have the floor to explain this suicidal choice of public funds?

Does Crypto allow global companies to be used as is the Forex function with respect to forex markets to hedge the currency risk associated with foreign transactions and anonymous transactions that convey money laundering as well as illegal goods transfer operations under the table?

In addition, more than 70% of bitcoins are stored for speculative purposes, this can be detrimental to its use, which calls into question its credibility following the fluctuations that these prices are experiencing as a result of these speculative operations. In addition, anonymity is used by technicians and e-merchants to purchase illicit goods.

At the start of 2017, there were over 500 virtual currencies with a total market value of $ 16.8 billion, Bitcoin alone accounted for around 85% of the market.

New technologies have given birth to new instruments of currency circulation in contemporary economies, such as cryptocurrency, therefore the creation of a global capital market requires the internationalization of currencies that circulate outside their space of traditional area of operation.[3]

Crypto-Moon Niet a Terre

Updated 9/9/2022 – Posted Initially December 5, 2021 – Said El Mansour Cherkaoui Sciences Po, Grenoble Institut de Recherche Économique et de Planification, Grenoble Institut des Hautes Etudes de l’Amérique Latine, Paris Université de la Sorbonne, Paris III Actuellement, tout ce qui touche le crypto actuellement est une aventure sans découvertes ni exploration si ce n’est la faillite au … Continue reading

Monetarism, Liberalism and Globalization: US Reactions and Coronavirus Clashes

The Aftermath of Coronavirus? Is this a Mathematical Formula or New Readings of Economic State Intervention? Where is the Invisible Hand of the Market? A second lecture more sincere of the works of David Hume and Adam Smith as well as David Ricardo needs to be conducted without having preconceived prism on our thoughts and perspectives that focus only and extract as well as manipulate … Continue reading Monetarism, Liberalism and Globalization: US Reactions and Coronavirus Clashes

Haiming WuHaiming Wu• 3rd+• Angel Investor,Founder,Entrepreneur, Architect and PM 1d • Edited • 4/6/2024 •

☻😈**Upcoming Crypto Court Cases After the SBF Saga**

With the sentencing of FTX co-founder Sam Bankman-Fried, the « trial of the century » in the crypto world has concluded. However, numerous other significant crypto-related court cases are still pending.

**Former Binance CEO Changpeng Zhao**

* Zhao pleaded guilty to money laundering charges last year.

* He faces up to 18 months in prison at his April 30 sentencing date.

* Prosecutors could argue for a maximum of 10 years.

**FTX Executives**

* Zixiao « Gary » Wang, Nishad Singh, and Caroline Ellison will be sentenced for their roles in the FTX fraud.

* Wang faces up to 50 years in prison, Singh 75 years, and Ellison 110 years.

* They may receive reduced sentences due to plea deals.

**Terraform Labs’ Do Kwon**

* Kwon faces fraud and market manipulation charges related to the collapse of his Terra ecosystem.

* He is currently free in Montenegro while his extradition is being debated.

* The SEC has filed a suit against Kwon for selling unregistered securities.

**Avi Eisenberg**

* Eisenberg is accused of exploiting the Mango Markets DeFi protocol for $117 million.

* He claims his actions were legal and will face a trial on April 8.

**Tornado Cash Developers**

* Roman Storm, a Tornado Cash developer, is charged with money laundering and operating an unlicensed money transmitter.

* He faces a maximum sentence of 45 years.

* His co-developer, Roman Semenov, is at large in Russia.

**Celsius Founder Alex Mashinsky**

* Mashinsky faces fraud and market manipulation charges with a maximum sentence of 115 years.

* He has pleaded not guilty and requested two charges be dismissed.

**SafeMoon CEO Braden John Karony**

* Karony is charged with securities fraud, wire fraud, and money laundering conspiracy.

* He faces a maximum of 45 years in prison.

**KuCoin and Co.**

* KuCoin and its founders are charged with failing to maintain an anti-money laundering program.

* The founders face up to a decade in prison but are at large.

**SEC Lawsuits**

* The SEC is pursuing lawsuits against numerous crypto firms, including Coinbase, Kraken, Tron, Gemini, and Ripple.

* The allegations include selling unregistered securities and operating unlicensed businesses.

#CourtCases

Centralized and Decentralized Exchanges (DEXs)

Centralized exchanges are managed by a centralized organization such as a bank that is otherwise involved in financial services looking to make a profit.

Decentralized exchanges rely on smart contracts to allow traders to execute orders without an intermediary.

Learn more:

Decentralized exchanges (DEXs) are fascinating components of the cryptocurrency landscape. Let’s explore what they are and how they function:

Definition: A DEX (Decentralized Exchange) is a peer-to-peer marketplace where cryptocurrency traders can transact directly with each other. Unlike centralized exchanges, DEXs bypass intermediaries such as banks, brokers, or custodians. Transactions on DEXs occur via self-executing smart contracts, which are coded agreements.

Key Characteristics: Peer-to-Peer: Traders interact directly, maintaining control over their funds.

No Central Authority: DEXs operate without a central entity overseeing transactions.

Transparency: All transactions are recorded on the blockchain, visible to anyone.

Privacy: Users retain privacy, as they don’t need to disclose personal information.

Security: Funds remain in users’ wallets until trades execute.

How DEXs Work: Order Books vs. Automated Market Makers (AMMs): Some DEXs use order books, similar to traditional exchanges. Buyers and sellers place orders, and the system matches them.

Others rely on AMMs, which use liquidity pools and algorithms to determine prices. Examples include Uniswap and PancakeSwap.

Liquidity Pools: Users contribute funds to liquidity pools, enabling trading pairs (e.g., ETH/USDT). In return, they earn fees from trades.

Smart Contracts: DEXs use smart contracts to automate trade execution. These contracts ensure fairness, security, and transparency.

Popular DEXs: Uniswap: Built on Ethereum, Uniswap pioneered AMMs.

PancakeSwap: A Binance Smart Chain (BSC) DEX with lower fees.

dYdX: Offers both spot and derivatives trading.

SushiSwap: Forked from Uniswap, it adds features like yield farming.

Raydium: On the Solana network, combining AMMs and order books.

Advantages of DEXs: Decentralization: Aligns with the ethos of cryptocurrencies.

Reduced Counterparty Risk: Users control their private keys.

24/7 Trading: No centralized operating hours.

Global Access: Anyone with an internet connection can participate.

Challenges and Considerations: Liquidity: Some DEXs have lower liquidity than centralized exchanges.

Slippage: Prices can vary due to liquidity constraints.

User Experience: DEX interfaces may be less user-friendly.

Regulatory Uncertainty: DEXs operate in a shifting regulatory landscape.

When using centralized exchanges for cryptocurrency transactions, there are several risks to be aware of:

Security Risks: Hacks and Breaches: Centralized exchanges are prime targets for cyberattacks. If an exchange is compromised, users’ funds can be stolen.

Insufficient Security Measures: Some exchanges may not have robust security protocols, making them vulnerable to breaches.

Liquidity Risks: Market Manipulation: In thinly traded markets, large orders can significantly impact prices. Traders may manipulate prices to their advantage.

Lack of Liquidity: Low liquidity can lead to slippage, where orders execute at unfavorable prices.

Counterparty Risks: Dependency on Exchange: Users entrust their assets to the exchange. If the exchange fails or becomes insolvent, users may lose their funds.

Regulatory Risks: Exchanges operate under varying regulatory frameworks. Changes in regulations can affect their operations and user experience.

Centralization Risks: Single Point of Failure: Centralized exchanges act as intermediaries. If they go offline or face technical issues, users cannot access their funds.

Loss of Control: Users rely on exchanges to manage private keys. This centralization contradicts the decentralized ethos of cryptocurrencies.

Privacy Risks: KYC/AML Requirements: Many exchanges enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Users’ personal information is collected, compromising privacy.

Data Breaches: User data stored by exchanges can be exposed in data breaches.

Exit Scams and Mismanagement: Exit Scams: Some exchanges disappear overnight, taking users’ funds with them.

Poor Management: Incompetence or mismanagement by exchange operators can lead to financial losses.

Market Risks: Volatility: Cryptocurrency prices are highly volatile. Users may experience significant gains or losses.

Flash Crashes: Sudden price drops can trigger stop-loss orders, causing cascading sell-offs.

Legal and Regulatory Risks: Uncertain Legal Landscape: Cryptocurrency regulations vary globally. Users may face legal repercussions due to unclear rules.

Exchange Shutdowns: Regulatory actions can result in exchange shutdowns.

While centralized exchanges offer convenience, they also come with risks. Diversifying holdings across different wallets and exchanges can mitigate some of these risks.

Updated– 12/21/2022 – 11/7/2022 – June 19, 2022 – July 6, 2022 – April 7, 2024

Creepy Crypto News and Abuses – Crypto Secret Mania – Crypto Greedy Mafia

Reader People Good Day

I have no idea how they can put people in front of a camera and have nice looking studio around while talking with assertiveness and they are introduced to us as the creme de la creme working for these companies that are the Top of the Top in their fields of actions and operations. After all these superlatifs, when we are listening to their explanations, all I am obliged to do is to try to discern what is the explanation and where is the analysis or even just the expression of descriptive narrative in their talk and answer, as we say again in French, “on reste sur notre faim” with these talking heads not thinking heads.

La Creme de la Creme turn out to be real sour and profoundly moldy and has no flavor or taste of great thought. It is worse than those “torchons” not of the Kitchen but what we call in Parigot, the language of Paris, the Newspaper that are only good to clean with the grass left on the counter or on the pot before passing them under the water to be clean.

There is apparently nothing to clean, as we say in America: “Where is the Beef” yes indeed, there was no beef at all so the pot and casseroles are clean. Given that Miss Clean has replaced Mr. Clean in the screen of these programs of TV Bidon, here is my predictions on what we are actually witnessing at the level of these assets that went South and wracked in Bahamas and Seoul before and in many other places around the world of the creepy and greedy ones that found their destiny drowned in a virtual world of supply chain of scams and Ponzi schemes with a plus: an Artificially Intelligent Scammer.

All comments, responses or any other possibilities of communication on these publications or other ones, here is my email: saidcherkaoui@triconsultingkyoto.com

Here are my publications that some were initially published as “Warning” and “Preventive Calls” and this on December 2021:

Terraform founder liable for fraud

Updated 4/7/2024 – Crypto mogul Do Kwon and Terraform Labs, the company he co-founded, have been found liable for defrauding investors in crypto securities. The jury verdict for the Securities and Exchange Commission comes one week after Sam Bankman-Fried was sentenced to 25 years in prison for leading a massive fraud at his FTX crypto exchange. The SEC brought the case against Kwon after Terraform’s TerraUSD stablecoin and a related cryptocurrency, Luna, collapsed in May 2022, erasing an estimated $40 billion in investor assets. Kwon also faces separate criminal prosecutions in the U.S. and South Korea.

Kwon, who owns 92% of Terraform, was arrested in Montenegro a year ago and convicted of attempting to travel using a fake passport. Authorities there are considering whether to extradite him to the US or to his native South Korea — he faces criminal fraud charges in both countries. »

Dot Come, Dot Gone in Late Nineties

My take on a high-tech startup in Silicon Valley: Dot Come, Dot Gone in Late Nineties Said El Mansour Cherkaoui was Executive Director of Business…

Fintech Frank Financial Fake Accounts

Fintech deal was a fraud Change & Con-tinuation Shut down Fintech Fake Frank Financial By Saundra Latham, Editor at LinkedIn News Updated …

Creepy Crypto News and Abuses

Creepy Crypto News and Abuses – Crypto Secret Mania – Crypto Greedy Mafia My Dear People Good Day I have no idea how they can…

Crypto Business Out of Electric Shocks

Initially posted- December 5, 2021 Updated- 12/21/2022 – 11/7/2022 – June 19, 2022 – July 6, 2022 Major crypto miner digging Chapter 11 Core Scientific,…

U.S. Finance Policy Facing High Tech Clouds

– Said El Mansour Cherkaoui – Trevor Ward, CPA

For the U.S. Financial Regulators, the Limit is NOT the Sky of the Financial Space, It is the Crypto Cloud Platforms – Next the European Central Bank will follow the Course

The U.S. Treasury Secretary Janet Yellen presided a financial stability council meeting today [10/3/2022] aiming to neutralize the risks coming from the Crypto Assets that can erode the U.S. financial stability.

➡️ Throw your real money through the window to understand #Bitcoin #Blockchain #cryptomonnaies

✅ What do think about all this ? ❤ 💡⚡ ✨ ✨

Said El Mansour Cherkaoui

#Bitcoin #blockchain #decentralized #centralized #innovation #creativity #entrepreneurship #future #management #strategy #startups #whatinspiresme #innoweek #pretotyping #designsprint #mvp #keynotespeakerance #cryptonews #research #investment #banque #bankruptcy

Time has given me confirmation and make my analysis right on the money and here the article I published on December 5, 2021 about Crypto Currencies as Crypto Casino Royal in reference to James Bond and the Secret Agents manipulating the CryptoMania

#Bitcoin and #crypto are two completely different things. Bitcoin is decentralized money that can’t be manipulated; cryptos are decentralized in name only (DINO) and exist on a spectrum of misguided/infeasible to outright scam. Unfortunately, this can be an expensive lesson for some people to learn.

Cascade of Crypto Complotop Virus is Spreading from the flat platform source to the Ocean of Investments and digital assets management

Latest Crypto Crime News

Another crypto company has fallen, as contagion from the collapse of cryptocurrency exchange FTX spreads across the industry: BlockFi says it has filed for bankruptcy.

Lender BlockFi was one of a handful of companies FTX bailed out in recent months, and its prospects worsened considerably as FTX imploded.

A little more than two weeks ago, the once mighty crypto giant FTX – founded by Sam Bankman-Fried to bring everyday people into the opaque world of virtual currencies – filed for bankruptcy. In the days since, the crypto industry, Wall Street, and even federal regulators have been on the outlook for the next domino to fall, wondering if the end of crypto is in sight or if wider financial stability is under threat.

Announcing its plans to file for Chapter 11 reorganization in New Jersey, where the company is based, BlockFi noted FTX’s own bankruptcy proceedings will lead to delays.

Robinhood Hit with the crash of the crypto market

April 2022, under the Hood, Robinhood have already fired 9% of its workforce in a previous round of layoff.

Robin the Hood in New York: Robinhood fined 30 Millions

Robinhood’s Crypto Arm Fined $30 Million Over Anti-Money Laundering Failures. New York’s top financial regulator on Tuesday August 2, 2022 fined the crypto arm of broker Robinhood Markets $30 million for allegedly breaching anti-money laundering and cybersecurity rules.

Robinhood cuts staff by 23%

Online brokerage Robinhood is laying off 23% of its workforce in its second round of staff cuts this year. The companywide job cuts are « part of a broader company reorganization, » CEO and co-founder Vlad Tenev wrote in a blog post, but the reductions mainly affect operations, marketing and program management roles. Tenev also says the decision for further cuts came after realizing April’s 9% headcount reduction « did not go far enough » when accounting for inflation and the crash in crypto markets.

- Robinhood’s crypto division has been fined $30 million by New York regulators who say they found « significant failures » in anti-money-laundering and cybersecurity compliance.

11 charged in crypto Ponzi scheme

SEC charges 11 people in alleged $300 million crypto Ponzi scheme

The Securities and Exchange Commission has charged 11 people with running a crypto-based Ponzi scheme that raised more than $300 million from investors. The platform, Forsage, allowed people to enter into so-called smart contracts that operated on the ethereum, tron and binance blockchains but which functioned like a pyramid scheme, in which profit could only be earned by luring others into it. Among those charged were three unidentified U.S.-based promoters who endorsed Forsage on their

Don’t send money over the internet to people you don’t know.

WOUNDED DUCKS FLYING TOWARD BANKRUPTCY FOR PROTECTION

Troubled cryptocurrency lender Celsius Network has filed for Chapter 11 bankruptcy protection, a month after it froze more than a million customer accounts. Before halting withdrawals, the New Jersey-based firm had accumulated more than $20 billion in assets by offering depositors interest rates as high as 18%. Celsius is the latest casualty of a crypto crash that has wiped out $2 trillion in value. Crypto broker Voyager Digital filed for bankruptcy last week, and major crypto hedge fund Three Arrows Capital sank into liquidation late last month.

Click below to sign up to make you Bucks flying like Ducks without sign of coming back to your way.

If you are following the scam crypto-markets you must avoid to attend this summer’s Digital Currency Summit.

If you have been crippled by the Crypto Casino Royal Market and lost all of your bets, better to get this Shock Treatment prescribed by those who know the best of the Crypto Scam, the New layers of liars who want to take what is left around you and still own by you, they are the new Savers and the new Warriors of the recovery process for themselves. These are the New Vultures trying to gauge themselves on the carcasses of the Crypto dead structures of the crypto scams.

Join more than two dozen scam industry experts including hedge fund managers, founders, CEOs, and blockchain pioneers as they gather to reveal the best opportunities in the future of crypto.

If they are that EXPERTS why they need to tell unknown people how to get rich while they are just paid for their presentations and could use first their advises for themselves and get rich and not to have to waist time in these presentations.

These EXPERTS will tell you how to give your Money to them and make them rich while you will be sitting there on the Docks of the Crypto Bay wondering what happen to my money while it is flying away and time cannot and will never bring it back to your way.

The Cascade of Crypto Virus is Spreading to the Ocean of Investments and the Sea of digital assets management

Crypto-Monnaie a Terre

Posted December 5, 2021 – Said El Mansour Cherkaoui – Updated June 19, 2022 & July 6, 2022 Sciences Po, Grenoble Institut de Recherche Economique et de Planification, Grenoble Institut des Hautes Etudes de l’Amérique Latine, Paris Université de la Sorbonne, Paris III Time has given me confirmation … Continue reading

Cryptop Dives in the winter and claims new victims among Investors

Time to buy warm lifejackets to swim in those troubled and cursed waters of cryptoceans

By Theunis Bates, Editor at LinkedIn News 7/6/2022

Troubled crypto brokerage Voyager Digital has filed for Chapter 11 bankruptcy protection, becoming the latest casualty of the spiraling crisis in digital asset markets. The Toronto-listed company commenced bankruptcy proceedings at a federal court in Manhattan after losing more than $650 million on a loan to Three Arrows Capital, a crypto hedge fund that fell into liquidation last week. Voyager stated in its filing that it has more than 100,000 creditors and between $1 billion to $10 billion in assets. It has liabilities in the same range.

Voyager last week froze all withdrawals, deposits and trading on its platform; other crypto firms, including Celsius and Babel Finance, have taken similar steps.

The overall market capitalization of crypto assets has plummeted from about $3 trillion last November to less than $1 trillion today.

Bitcoin dropped below $19,000 for the first time since late 2020, and Ethereum tumbled below $1,000, as cryptocurrencies’ « brutal slide » gets aggravated by the Fed’s aggressive rate hike, CNBC reports. The rate increase led to a pullback on high-risk investments in the midst of the crypto market’s monthlong $2 trillion beating. Over the past few weeks, the crypto ecosystem been hammered by the $60 billion implosion of two coins — including one of the most popular U.S. dollar-pegged stablecoins — layoffs and at least two firms froze withdrawals.

Crypto coined assets bad news week as told by Babel, Celsius, and Three Arrow Capital – The Verge

Three big firms — Celsius Network, Three Arrows Capital, and Babel Finance — appear distressed. The trouble in the market …

Three big firms — Celsius Network, Three Arrows Capital, and Babel Finance — appear distressed. The trouble in the market … Crypto was touted as a bulwark against currency debasement and a hedge against inflation but just when the dollar inflation hit a 40 year high, the cryptos failed in its single most important mission – protect value!

Another crypto lender orders freeze – 6/17/2022

With the cryptocurrency market in meltdown, Babel Finance on Friday halted all withdrawals, becoming the second major digital-token lender in a week to order a freeze. Valued at $2 billion last month, the Asia-based firm said it was facing “unusual liquidity pressures.” The announcement comes just days after the Celsius Network — which hosts the savings of more than 1 million people — paused withdrawals to stop a crypto bank run. Bitcoin has lost 70% of its value since November, while the value of all crypto has plummeted from $3 trillion to $1 trillion.

Crypto lenders do not have the investor oversight and legal protections of traditional banks and brokerages, so customers risk losing all their assets in a crash.

Crypto markets’ drastic plunge – 6/13/2022

Bitcoin dropped some 15% to a new low during Monday, falling below $24,000. It’s an 18-month low for the world’s biggest cryptocurrency and forced crypto lending firm, Celsius Network, to hold withdrawals and transfers, a « drastic action [that] risks insolvency, » a crypto expert told by Yahoo. Bitcoin’s value tumbled after U.S. inflation hit a 40-year high Friday June 6, 2022 June , ramping up pressure on the Federal Reserve to continue increasing interest rates. Over the weekend, more than $200 billion was erased from the crypto markets.

Stocks are also sinking following Friday’s inflation news, with indices across the board taking a dive. Source LinkedIn

Inflation hits 40-year high (again) – 6/11/2022

Inflation has surged to yet another 40-year high, startling economists and ramping up pressure on the Federal Reserve to continue increasing interest rates. The consumer price index soared by 8.6% from a year ago, according to the Labor Department — a 1% jump from last month, shattering economists’ expectations. The voracious growth in consumer prices is being felt in many facets of American life, particularly when it comes to groceries, rent and at the gas pump.

Grocery prices are up 11.9% annually — their highest rate since 1979, according to government data. Further, energy prices jumped 34.6% from a year earlier, with gas prices up 49%.

The irrepressible growth of consumer prices is a worldwide problem, as Russia’s invasion of Ukraine ensures inflation becomes « stubbornly entrenched in countries around the globe. » Source LinkedIn

Now after all these collapses even the one that have proposed to create Crypto Euro Wallet are backing away and now they are rushing and competing who is going to say the most accurate condamnation of « Crypto Coined Assets »

A “pyramid scheme,” “worth nothing” and “not reliable” — cryptocurrencies have been given a scathing review by top officials gathering in Davos, Switzerland for the World Economic Forum’s 2022 meeting.

Digital assets are a hot topic after the collapse of stablecoin TerraUSD sparked a major cryptocurrency crash this month, with around $1 trillion wiped out of the market.

Bitcoin, once worth more than $54,000, was trading at $23,424 on Tuesday, according to Coinbase, and is down by around 37% year-to-date. Other popular cryptocurrencies, like Ethereum and Solana, have seen even bigger year-to-date losses.

International Monetary Fund Managing Director Kristalina Georgieva compared some cryptocurrencies to pyramid schemes.

“When somebody promises you a 20% return on something that is not backed by any assets, what would we normally call this? We would call it a pyramid,” she said during a panel discussion on Monday.

“In other words, this is a pyramid [scheme] in the digital age.”

Speaking to WEF Founder and Executive Chairman Klaus Schwab for an episode of Radio Davos, European Central Bank President Christine Lagarde said “cryptocurrencies are not currencies at all.”

“They are speculative assets, the value of which changes enormously over the course of time, and they present themselves as currencies, which they are not,” she said.

“We should call a spade a spade. An asset is an asset, it has to be regulated as such, has to be supervised by the asset regulators and supervisors, but should not claim that it is a currency. It is not.”

François Villeroy de Galhau, governor of the Bank of France, said at Davos on Monday that he does not refer to crypto assets as cryptocurrencies.

“They are not reliable currencies, they are not a reliable means of payment,” he said. “In order to be a currency somebody must be responsible for the value — nobody is responsible for the value of cryptos. And it must be accepted universally as a means of exchange — it’s not.”

An investment, not a means of payment

Meanwhile, Sethaput Suthiwartnarueput, governor of the Bank of Thailand, told an audience at Davos: “It’s fine if you want to invest in [crypto], but we don’t want to see it as a means of payment because it’s not appropriate.”

Thailand’s central bank is developing a digital currency for the public, but the country announced earlier this year that it was banning the use of cryptocurrencies as a method of payment, saying widespread use of digital assets was a threat to the Thai economy.

Bitcoin plunges overnight – CNN

KEY POINTS BY European Central Bank President Christine Lagarde

“Our work aims to ensure that in the digital age citizens and firms continue to have access to the safest form of money, central bank money,” Christine Lagarde, the ECB’s president, said.

The digital euro would allow consumers to pay electronically, without the need for banknotes and coins.

However, it would “complement” the existing monetary system rather than replacing physical cash and erasing the business of commercial lenders.

Nine months of analysis and experimentation, « has led us to decide to move up a gear and start the digital euro project,” ECB President Christine Lagarde said.

#blockchain #cryptocurrency #crypto #bitcoin #euro #venturecapital #angelinvestors #banking

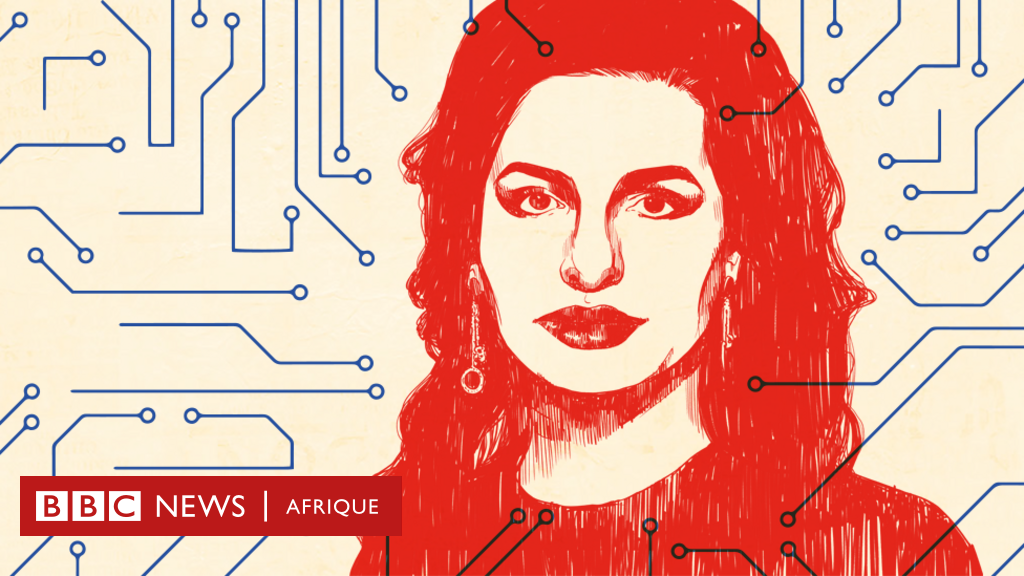

OneCoin, led by the now infamous international fugitive Ruja Ignatova known as the « Cryptoqueen, » sold educational cryptocurrency trading packages to its members, who were then given commissions to sell packages to more new members. At its peak, the company claimed to have as many as 3 million members from around the globe.

« Cryptoqueen » accomplice Christopher Hamilton is facing extradition to the U.S. after a British judge rejected his bid to delay the process .

District Judge Nicholas Rimmer rejected the bid to hold off on extradition, Law360 reported. Hamilton is accused of laundering $105 million in connection with the OneCoin ponzi scheme.

The famous infamous Dame which I baptized as Madame “OneCoin Maniac”?

Ruja Ignatova of OneCoin known as the « Cryptoqueen » – OneCoin « induced investors all over the world to invest in this actually worthless currency, » according to Europol. The Ponzi scheme is estimated to have netted about $4 billion. Ignatova is on Europe and the FBI’s most wanted list. It is widely considered the biggest scam yet in the history of crypto.

Since the fire baptism, she has never shown the other side of this « OneCoin » as she has never shown the other side of her real face, Bingo et Hasta la Vista Crypto !!!

In early June 2016, 36-year-old businesswoman Dr Ruja Ignatova took the stage at Wembley Arena in front of thousands of raving fans. She was dressed, as usual, in an expensive ball gown, wearing long diamond earrings and bright red lipstick.

She told the enthusiastic crowd that “OneCoin” was set to become the world’s largest electronic currency “for anyone to make payments anywhere”.

“Bitcoin” was the first electronic money and remains the largest and most well-known – its rise in value from pennies to several hundred dollars per coin in mid-2016 had caused a frenzy of enthusiasm among investors.

The idea of digital currency had only just come into vogue. A lot of people were looking to get involved in this strange new opportunity.

“OneCoin,” Dr Ruja told the Wembley audience, was the “Bitcoin Killer”. “In two years, no one will be talking about Bitcoin!” She cried.

All over the world, people were already investing their savings in OneCoin, hoping to participate in this new revolution.

Documents leaked to the BBC show the British spent nearly € 30m (FCFA19,678,709,999) on OneCoin in the first six months of 2016, including € 2m (FCFA 1,311,913,999) in just one week – and that the investment rate could have increased after the Wembley extravagance.

Between August 2014 and March 2017, more than 4 billion euros (2,623,828,000 FCFA) were invested in dozens of countries.

From Pakistan to Brazil, from Hong Kong to Norway, from Canada to Yemen… and even in Palestine.

Professor Eileen Barker of the London School of Economics, who has spent years studying groups like the Moonies and Scientologists, says there are similarities between OneCoin and the messianic millennial cults, where people believe they are part of of something big that will change the world – and no matter the evidence, once registered, it is very difficult for them to admit their mistakes.

“When the prophecy fails, they believe more firmly,” she says. « Especially if you have invested something, not only money, but also faith, reputation, intelligence. You think: ‘Wait a little longer.’

Money can drive people to invest, but the sense of belonging, of doing something, of accomplishing something, is the reason they stay, Barker says. « And in that sense, it’s worship. »

Ruja Ignatova called herself the “queen of digital currency”. She told people that she invented electronic money to compete with Bitcoin, and persuaded them to invest billions.

Then, two years ago, she disappeared.

Bitcoin: comment une femme a arnaqué le monde, puis s’est volatilisée – BBC News Afrique

Comment Ruja Ignatova a-t-elle gagné 4 milliards de dollars en vendant sa fausse monnaie numérique au monde – et où est-

The use of crypto assets as a currency is forbidden for Muslims, according to Indonesia’s council of religious leaders. Nov 11, 2021

For the moment it is a pure scam like the casinos

A currency that floats without direction, nor productive and growing added value, and which is also not based on a reserve.

This reserve should be a surplus of which several interbank transactions verify and sanction, control and increase its basis for transfer, convertibility [example of central banks and LIBOR] and achievements as a form of deposit, exchange, conversion, settlement. , loan and support for integrated productions in the circuit of regional, national and interbank international circulation.

Add to this, Cryptomania is not used for the payment of debts, financial obligations such as taxes.

If all these procedures do not exist in the fiduciary identity and the financial value of Cryptomania, it cannot therefore claim institutional financial and legal legitimacy.

It is neither the number of participants, nor the level of transactions, nor the amount achieved, nor the slogans and propagandist speeches that will give legitimacy to Cryptocracy and Cryptorobotech.

The Suitcase and the Briefcase – Empty Case

This new monetary technology is not geographically limited because it is based on the Internet. Among the most famous currencies, we find Bitcoin, Ethereum, Litecoin, XRP, Cardano, EOS, Monero, etc ….

Cryptocurrency is a new form of currency whose nature ultimately remains unclear or ambiguous, insofar as it cannot be reduced to either scriptural or fiat money. Payment information is stored on a smartphone and is securely encrypted to authorize payments.

It is a currency that allows you to make online payments from a website. This currency does not belong to any state, it is not materialized and is not issued by any central bank, and which is not subject to any supervision by any country or any other regulatory body, it is a currency without bank, received by its own network users. Cryptocurrencies have multiplied and varied, and the differences between them are related to creation, time spent in the trading process, method and distribution, and others are related to the algorithms responsible for the process of trading.

The most important risk is that these users are not fully protected, so the responsibilities in case one of the parties does not respect these commitments is difficult to determine if not impossible, even the modalities of dispute resolution.

This situation does not please the States or the central banks, which today want to regulate this virtual currency which escapes them, certain countries like Japan or France even want to tax the exchanges in bitcoin, other States have outright banned like the China and Bolivia.

Cryptocurrency adoption in Africa

Nigeria has one of the fastest growing peer-to-peer Bitcoin markets in the world, but so far the country has banned cryptocurrency and warned its citizens that Bitcoin investments have no cover. legal. On January 12, 2017, the CBN (Central Bank of Nigeria) warned all banks and financial institutions in Nigeria to never use, hold, exchange or trade any virtual currency. On February 5, 2021, the CBN ordered banks across the country to close the accounts of anyone transacting in cryptocurrencies.

Not only Nigeria, but also Morocco, Algeria, Libya, Egypt, Zambia, Zimbabwe, and Namibia have banned the use of cryptocurrency. In Kenya, the government is neither receptive nor opposed to cryptocurrency. However, it also warns its citizens that it is not legal tender, and therefore offers no protection for any failure that may appear in the cryptocurrency business. In South Africa, there are no specific laws or regulations that deal with the use of virtual currencies, however, a working group has been established on the regulation of crypto assets examining the country’s position on the subject.

For demand factors, E-commerce has created the need among users to be able to consume at a distance, it should be noted that crypto-currencies are used in E-commerce operations. Today, millions of virtual money transactions are exchanged, such as bitcoin and others (Amazon coins, Ripple, Litecoin, Solidcoin, etc.).

What is attractive to these companies is that cryptocurrency has the irreversible nature of payments. In other words, a settled transaction gives sellers a guarantee that the transaction is not at risk of being canceled.

Economic instability in Africa is one of the reasons Africans are switching to cryptocurrency. Companies like Bitcoin do not have a single domain, the money exchanged by the company is not affected by the inflation rates of a single country allowing citizens to protect their income from a failing economy. In addition, cross-border payments are easier with Bitcoin.

For example, Paypal has already been banned in Nigeria due to its fraudulent and money laundering activities, but cryptocurrency companies use blockchain technology that stores public documents in a decentralized system, which means transactions cannot be banned from a single country. In addition, cryptocurrency transactions are fast, transaction costs are lower and there are no intermediaries as they are decentralized.

Finally, they are cryptographically secure. Business owners in Africa often want to expand their business internationally. Some of these companies have started using blockchain and cryptocurrency in order to gain the attention of the international market and protect companies against currency devaluation.

Thus, the government ban on cryptocurrency cannot stop virtual currency online transactions. Some of these companies have started using blockchain and cryptocurrency in order to gain the attention of the international market and protect companies against currency devaluation.

Major crypto miner digs for Chapter 11

Energy Price Comparison

Research by the Energy Price Comparison Service shows that the amount of energy spent on Bitcoin mining around the world has already exceeded the amount used on average by Ireland and most African nations and is greater than the annual usage of nearly 160 countries. Miners are turning to increasingly powerful computers to accomplish these tasks and earn Bitcoin, and as a result mining (and, in return, Bitcoin transactions) is consuming more and more electricity. Indeed, according to the Dutch bank ING, a single Bitcoin transaction consumes as much electricity to power a house for an entire month.

Core Scientific, one of the country’s largest publicly traded cryptocurrency mining firms, has filed for Chapter 11 bankruptcy protection, becoming the latest domino to topple in 2022’s « crypto winter. » The Texas-based company says it will continue to mine Bitcoin and other digital currencies, though, as it pays down debt. Core Scientific still has positive cash flow, an anonymous source tells CNBC, but isn’t making enough money to pay the financing charges on equipment it has leased.

- Bitcoin, the primary currency minted by Core, has plunged more than 60% this year; Core’s stock is down 98%.

Mario Andres Gutierrez, Msc• 3rd+Bitcoin – Mining | Oil & Gas – Energy

While speculated over the last couple of months, Core Scientific formally files for chapter 11 bankruptcy only less than 18 months after going public.

#CORZ is know as one of the largest self miners and hosting providers in the industry. Increasing energy prices and plummeting hashprice certainly put pressure on their ability to pay their loans.

While they work to reach a deal with senior creditors, they will keep operating instead of liquidating assets. As Q1 and Q2 certainly will see more bankruptcies, do you think that will be norm, or will we see liquidations of sorts such as in the Compute North case?

Shout out to MacKenzie Sigalos for great coverage of the space as always!

Bitcoin miner Core Scientific is filing for Chapter 11 bankruptcy — but plans to keep mining – cnbc.com •

Matt Rosoff• 3rd+Editorial Director, Tech and Climate at CNBC

It’s been a rough year for bitcoin mining, as plunging crypto prices coincided with rising energy costs. Core Scientific, which had warned it might go bankrupt earlier this year, is the latest victim. But the company is still earning positive cashflow from mining, so it is not dissolving, and will continue to mine while it restructures, according to a person familiar. MacKenzie Sigalos has the full story:

Bitcoin miner Core Scientific is filing for Chapter 11 bankruptcy — but plans to keep mining – cnbc.com •

Wow. What a failure. Apparently, some management teams use numbers like a drunk uses a lamppost. Both of them use it for support rather than illumination. Unfortunately, the investors that go along for the ride end up getting burnt.

Crypto miner Core Scientific files for bankruptcy as industry contagion bites – reuters.com •

Daren Firestone out of network 3rd + Partner at Levy Firestone Muse

Most miners can’t make money right now because the marginal cost of equipment plus the marginal cost of the power required to run miners exceeds revenue. I’m not sure this spells the end of crypto but it definitely calls into question proof of work. Also, if a mining company claims to be making money in the current climate, be highly skeptical.

In response to Kelvin Low’s post:

Kelvin Low • 3rd+Professor at Faculty of Law, National University of Singapore

And so a crypto canary croaks. Many sceptics have been saying that crypto miners are canaries in the crypto coal mine. Now, Core Scientific bites the dust.

CNBC reports: « Core Scientific, one of the largest publicly traded crypto mining companies in the U.S., is filing for Chapter 11 bankruptcy protection in Texas early Wednesday morning, according to a person familiar with the company’s finances. The move follows a year of plunging cryptocurrency prices and rising energy prices.

Core’s market capitalization had fallen to $78 million as of end of trading Tuesday, down from a $4.3 billion valuation in July 2021 when the company went public through a special purpose acquisition vehicle, or SPAC. The stock has fallen more than 98% in the last year.

The company is still generating positive cashflow, but that cash is not sufficient to repay the financing debt owed on equipment it was leasing, according to a person familiar with the company’s situation. The company will not liquidate, but will continue to operate normally while reaching a deal with senior security noteholders, which hold the bulk of the company’s debt, according to this person, who declined to be named discussing confidential company matters. »

This is a serious problem throughout the cryptoverse. Much of the problems of this year would not have been as serious but for the cryptoverse binging on leverage.

« Core had previously said in a filing in October that holders of its common stock could suffer “a total loss of their investment,” but that may not be the case if the overall industry recovers. »

I hope the industry realizes that much of the previous « recovery » from the previous crypto winter was simply leverage binging, in large part in response to pandemic QE. Are we expecting another pandemic?

Nor is Core Scientific alone:

« Compute North, which provides hosting services and infrastructure for crypto mining, filed for Chapter 11 bankruptcy in Sept., and another miner, Marathon Digital Holdings, reported an $80 million exposure to Compute North.

Meanwhile, Greenidge Generation, a vertically integrated crypto miner, reported second quarter net losses of more than $100 million in August and hit “pause” on plans to expand into Texas. And shares in Argo plunged 60% after its announcement on Oct. 31 that its plan to raise $27 million with a “strategic investor” was no longer happening. »

Whether the troubles facing the miners will cause a further collapse in crypto prices will depend on how Core Scientific’s bankruptcy (and others that are likely to follow) plays out. If any of these miners are forced to sell their crypto to repay creditors in fiat, then expect prices to fall further.

James Bone• 3rd+Executive Director, Founder at GRCIndex (DBA -Cognitive Risk Institute)

The façade of a digital currency is unraveling slowly as we watch an experiment in finance blow up over the same bad behavior as traditional financial institutions and poor regulatory oversight.

“One of the largest US-listed bitcoin miners has filed for bankruptcy as companies battle falling token prices and rising costs for the energy-intensive business of churning out cryptocurrencies.

Core Scientific filed for Chapter 11 bankruptcy protection in Texas, where it is based, on Wednesday. The company said it planned to keep operating and producing bitcoin while it hammered out a restructuring deal with its lenders and creditors”

#cognitiverisk #cognitivehack #cognitiveriskframework #humanelement #management #leaderahip

US bitcoin miner Core Scientific files for bankruptcy – ft.com •

Here’s why it’s important that the bitcoin price has hovered at the average mining cost of ~$17,000 since November 9 (45% of a proposed rescue package hangs on a BTC price of $18,500). It’s not « money », folks (https://lnkd.in/ewAmmtHG).

Bitcoin Miner Core Scientific Files for Bankruptcy, Expects Support From Some Debt Holders – coindesk.com •

Core Scientific’s estimated liabilities and assets are between $1 billion- $10 billion, according to its bankruptcy filing.

#bitcoin #mining #bankruptcy

Response from Said El Mansour Cherkaoui

First of all, I would like to have specific quotes on what you write as such and I quote you:

“Today, countries, large institutions and international companies have converted some of their money into crypto …”

In addition to giving names, I would also like to know the amounts and their end use by these countries, institutions and international companies.

Likewise, these conversions of “a portion of their money into crypto ..” are carried out and again, what are the end uses and their corresponding transactions.

These amounts in foreign currencies, they have what like guarantee and reserve of reference of their solvency at the level of the nominal value, the exchange value and the level of the convertibility value.

Regarding the reaction of legal tender of central banks and cryptocurrency, through the central bank’s controlled introduction of central cryptocurrency, within an appropriate regulatory and technical framework.

Apart from supply and demand and once again I quote you:

“Today, countries, large institutions and international companies have converted some of their money into crypto …” Do these types of transactions have the same instruments as the foreign exchange market (FX or forex) or national currencies they exchange against each other via cryptographic realizations.

Does this crypto conversion provide hedge against international currency and interest rate risks and allow them to speculate on geopolitical events and diversify their portfolios?

On the other hand in FOREX, the main players in this market are usually financial institutions such as commercial banks, central banks, fund managers and hedge funds, there is no country.

But you support and once again I quote you: “At present the countries,…. Have converted part of their cash into crypto…. So the question that arises is, how do countries stay away from FOREX and invest in crypto?

Do you have the floor to explain this suicidal choice of public funds?

Does Crypto allow global companies to be used as is the Forex function with respect to forex markets to hedge the currency risk associated with foreign transactions and anonymous transactions that convey money laundering as well as illegal goods transfer operations under the table?

In addition, more than 70% of bitcoins are stored for speculative purposes, this can be detrimental to its use, which calls into question its credibility following the fluctuations that these prices are experiencing as a result of these speculative operations. In addition, anonymity is used by technicians and e-merchants to purchase illicit goods.

At the start of 2017, there were over 500 virtual currencies with a total market value of $ 16.8 billion, Bitcoin alone accounted for around 85% of the market.

New technologies have given birth to new instruments of currency circulation in contemporary economies, such as cryptocurrency, therefore the creation of a global capital market requires the internationalization of currencies that circulate outside their space of traditional area of operation.

Crypto Casino Royal – Cryptop Secret Mania CRYPTOCURRENCY Posted December 5, 2021 – Said El Mansour Cherkaoui – Updated June 19, 2022 & July 6, 2022 Sciences Po, Grenoble Institut de Recherche Economique et de Planification, Grenoble Institut des Hautes Etudes de l’Amérique Latine, Paris Université de la Sorbonne, Paris III Time has given me confirmation … Continue reading

Cryptocurrency and Currency – Hamadi Mokhtar

LA CRYPTO-MONNAIE ET SES EFFETS SUR LA POLITIQUE

Prepared by the researcher Professeur. TCHIKOU Faouzi – Université Mustapha STAMBOULI de MASCARA Doctorant . HAMAIDI Mokhtar – Université Mustapha STAMBOULI de MASCARA Democratic Arab Center Journal of Afro-Asian Studies : Ninth Issue – May 2021 A Periodical International Journal published by the “Democratic Arab Center” Germany – Berlin. The journal deals with the … تابع قراءةLA CRYPTO-MONNAIE ET SES EFFETS SUR LA POLITIQUE المركز الديمقراطي العربي

Does Matt Damon have crypto regret?

By Theunis Bates, Editor at LinkedIn News

Are Matt Damon and LeBron James suffering from crypto regret? They are just some of the big names who’ve boosted cryptocurrencies in ads over the past year, portraying digital currencies as a financial revolution — and an easy way to make a stack of cash. But with the crypto market in meltdown, those same celebs have gone silent, reports The New York Times. Critics are now accusing the stars of pushing fans toward volatile investments without explaining the risks. And marketers are wondering if a continued crypto downturn will damage these celebs’ reputations.

Fortune doesn’t favor the brave, it favors the educated.

You know what would be cool, if celebrities did flashy advertising campaigns for financial literacy instead of endorsing a digital currency or investment.

As an advisor who’s been helping people with their money for over 16 years – rarely, if ever, does advice (if we can even call it that) from advertising campaigns provide any real value to those it targets.

Imagine if we put a focus on financial education and advice led planning instead of trying to push what is hot & sexy today?

I have nothing against crypto but investing in it, or virtually anything, because a celebrity told me to does not appear to be a great plan.

I would love to see those who have the influence to focus more on promoting education that genuinely help the end customer.

It may not pay Matt Damon and others as much, but it certainly will drive a lot of good will and have exponentially positive effects.

What do you think, should celebrities be touting « investments », financial education? Something else?

#financialliteracy #education #investments #crytpo #litrendingtopics

As I discussed at the recent Milken Institute Global Conference, most cryptocurrencies are currently 0 for 3 when it comes to PGIM‘s criteria for a fiduciary investment – clear regulatory oversight, a steady store of value beyond what someone else will pay for it, and predictable correlations with other asset classes. While we don’t believe crypto should be an investment option in fiduciary accounts, there are emerging opportunities in the broader blockchain ecosystem.

For more perspectives on crypto, see the latest installment of PGIM’s Megatrends research here: https://on.pru/3wrGfrM #Cryptocurrency #MIGlobal #CryptoInvesting

Celebrity endorsers keep quiet as cryptocurrency market appears to crash

Mark Toner• 3rd+The ‘shiny objects’ that count are the ones you deposit in a bank •

Take the bitcoin and run.

How did those Super Bowl ads work out?

Crypto needs to be treated like a pharma drug with a fair balance – of side effects listing. « May cause sleepiness nights, bank account depletions, smashing your Bourne DVD collection, etc etc

All Those Celebrities Pushing Crypto Are Not So Vocal Now

Patrick Derdeyn out of network3rd+Regional Vice President at Viant Technology

It’s not and was a never a risk free opportunity, nor did they make any promises or need to hold any responsibility. The marketing and branding being done by the exchanges is completely irrelevant to the state of the market. Do people start blaming Charles Schwab and Etrade commercials when the stock market goes down? More than anything this just shows what a nascent space this still is, yes it provides the opportunity for financial freedom but the best advice always will be DYOR and know your risk.

Robert B. Childers out of network3rd+Cyber Security Analyst/Systems Security and Remediation

Do the sheep, who listened to Matt Damon have crypto regret? Does Matt? He was paid in BITCOIN, turned that into American cash, and put it in his MSFT, Alphabit, AMZN, stocks, and he is quite happy. He probably put some cash into a stock (F), and maybe DOGE? Nah, he didn’t buy that.

Bryan Paxton out of network3rd+Systems Analyst/Field and Desktop Support

I love your list of side effects. Nice

Edward Czajka out of network3rd+EVP/CFO at Preferred Ban

Didn’t he say, and I quote, ‘Fortune favors the brave’?

It is hubris and ignorance to think that someone with no professional financial training and experience should tout an investment. Because he’s an actor we should follow his financial advice?

Luisa Alberto(She/Her) out of network3rd+CEO of People First Finance; a Virtual CFO agency helping women business owners manage their finances with ease by offering bookkeeping, tax planning, and financial strategy all under one roof

My question is, why are we pointing fingers at these celebrities and advertisements when it is OUR responsibility to make intentional, informed investments? Do your research, know the risk involved, and be confident in your investments for the long run.

Nick Bauer out of network3rd+Marketing & Implementation Manager at New Vista Solutions

They all got big bucks for those commercials. Laughing all the way to the bank…unless they were stupid enough to ask to be paid in crypto.

Ralph Hightower out of network3rd+Photographer; retired computer software developer (C#, .Net), still active for personal projects. Manned Spaceflight enthusiast. Witnessed two final flights: Apollo/Soyuz, Space Shuttle STS-135.

In my opinion, someone burned $5,000,000 for a qr code in a game of pong (70’s arcade video game).

Mike Goldberg 2nd degree connection2ndB2B Marketer | Content Writer & Strategist | Brand Storyteller | VP, Marketing

Will we look back on all the crypto commercials this year the same way we look back at all the dot-com ads of 1999? I’m looking at you Puppet Dog Sock thing…

Juan Suero Robotics out of network3rd+Robotics Engineer, Kubernetes Industrial Automation Cloud Architect at SpiritZ Robotics

just pay the roof over your head.

Ray Godleski out of network3rd+Help individuals, families and business owners achieve better results. Starting with the first conversation, people can visually see how their plan can be improved.

Once an actor gives investment advice….

Steven M. Brown, MSP(He/Him) 2nd degree connection2ndI help Construction Professionals find their next job opportunity!

This is the beginning of the next four year cycle.

Joshua Miller out of network3rd+Project Manager Design II

if something is being sold as too good to be true it probably is.

Neer Lazar out of network3rd+Customer Success Manager at ContractPodAi

My AAPL is tanking harder than my BTC so what is the point exactly?

Forrest Claypool out of network3rd+CEO, Instant Connect Software

Outrageous to see all these celebrities take money to tout something they know nothing about, with gullible star gazers following them like lemmings off the financial cliff

Lauren LoFrisco(She/Her) out of network3rd+Head of Marketing, Brand Performance and Client Partner Development

Yes, so true. when times are good, people can get bold and forget about that the risks are real

Joe Weaver (JoeWeaver.me) out of network3rd+Designer, Developer, Teacher, Project Manager, Consultant

Never smashing my Bourne DVD collection. Great films.

(And the books are even better! Very different than the films)

A $200B crypto wipeout

By Theunis Bates, Editor at LinkedIn News

More than $200 billion was wiped from cryptocurrency markets Thursday after the “stablecoin” TerraUSD suddenly plummeted in value, sending shockwaves through the whole sector. Stablecoins are supposed to be backed by reserves such as U.S. dollars or other traditional assets and are intended to serve as safe havens in times of market volatility. But TerraUSD is an algorithmic stablecoin backed by code, not cash. A sell-off in its sister currency, Luna, sent Terra to a low of 23 cents Wednesday. Other cryptocurrencies also took a beating amid the panic:

Tether, the world’s largest stablecoin, sank below its $1 peg Thursday.

Bitcoin, the largest cryptocurrency, dropped to its lowest level in 16 months; it has lost more than 45% in value so far this year.

Cryptocurrency trading platform Coinbase has lost more than half its value in a week.

Andrew Beer• 2nd Managing Member at Dynamic Beta investments LLC •

For anyone following the $LUNA debacle and the #crypto meltdown:

I have zero useful technical expertise to explain what happened and why, but this feels like a game changer in several respects:

1. The dollars are big: if my math works, $90 bn in a month.

2. The human impact is real: Per reddit, many people lost their life savings and some are suicidal.

3. This will be THE crypto story for a while — just smells like a massive ponzi scheme on steroids when you get promised 20% returns with no risk.

4. Regulators — both in the US and abroad — will face huge pressure to act and act fast.

5. Political will of the crypto lawmaker lobby will wither.

6. Institutions like banks will need to step back to reassess everything — no one wants to get dragged into the next litigation blender.

We shall see..

Jack Denton• 3rd+Journalist focused on cryptocurrencies and decentralized finance •

There is a crash in the cryptocurrency world. Around $600 billion in digital asset market capitalization has been wiped away in the last week, with the price of Bitcoin falling 25%.

Part of that has to do with the stock market, and investor sentiment for bets that are viewed as risky.

But the meltdown of a stablecoin called Terra—designed to be pegged to the U.S. dollar—was a significant factor. It comes as lawmakers press for new regulations on stablecoins, which represent the bedrock of the crypto economy.

My story for Barron’s:

How a Digital Token Designed to be Stable Fueled a Crypto Crash

Dror Poleg• 3rd+Rethinking work, money, and cities. 4h •

Stablecoins offer the benefits of Decentralized Finance, minus the volatility of traditional tokens. At least that’s the theory.

In practice, some stablecoins have struggled to maintain their value — leaving customers bruised and confused.

Current market turmoil paves the way for more regulation and broader adoption of stablecoins as official government currency.

Are Stablecoins Stable?

Dror Poleg on LinkedIn •

The crypto market is tumbling. It’s not the first time or the last. Volatility is one of the things that make cryptocurrencies attractive to investor

Crypto Armageddon is underway as panic selling hits crypto markets, Tether breaks its dollar peg, and Bitcoin hits new lows.

While I normally don’t write much about crypto, tonight, there really is only one story: the crypto market tanking!

I’m sorry to report this, and I am not gloating, even if I disapprove of the raw greed that the sector seems to worship. Still, this will be seen as a historic day given the magnitude of the losses, so let’s dive in.

Why are markets tanking? The obvious explanation is their high degree of correlation with equity markets, which are pounded by rate rises. That makes sense, but I do believe that there is more to the story.

My take on it is that fear levels have simply reached the breaking point for the majority of crypto holders.

Just like a religion, crypto markets are challenging the faith of their followers, and the vast majority have had enough. Most are simply not going to sacrifice what little savings they have left on the alter of crypto.

Can you blame them? Who can afford to watch losses of 50+% and stand there and do nothing?

Now it’s not just the losses. The headlines from this week show not just loss, but corruption:

1) Failure of Terra algorithmic stablecoin dropping some $50bn in market capitalization hit the market hard.

2) Reports that Terra founder Do Kwon launched another failed algorithmic stable coin a few years ago! “If at first, you don’t succeed, try, try again!”

3)Bitcoin’s ongoing slide, which, while exacerbated by Terra, was well underway before Terra’s fall.

4)Reports this week that 40% of crypto owners are now losing money on their investments.

5) Coinbase, which is down 78% for the week, will have the rights to your crypto if they ever go bankrupt!

6) Reports from SEC head Gary Gensler that crypto exchanges are “trading against their customers often because they’re market-marking against their customers.”

Still, despite the crash and bad news, this doesn’t mean that crypto is dead even if most of it should die.

One constructive comment on cryptos’ future that I hope the community can get behind came from a surprising place.

CZ, the billionaire head of Binance stated on Twitter that:

“At the end of the day, we need to go back to fundamentals. Build real products, not reliant on short term incentives, or promotions, but with intrinsic value that people use.”

So I don’t wish ill will toward crypto holders, nor am I gloating at their losses.

I do, however, wish that the considerable talent and resources of the crypto world would go back to “building real products with intrinsic value that people use.”

Thoughts?

PS: PLEASE hit the like button and leave a comment! Recent Linkedin algo changes are making it harder than ever! Did you know the LinkedIn algorithm weighs one comment equal to 10 likes?

Connect for more on #China‘s #CBDC, #fintech, #technology, #innovation and my book “Cashless”

More like un-stable coin… 300M so far in processed redemptions is peanuts compared to its 83 Billion dollar market cap… THEY DO NOT GUARANTEE REDEMPTIONS!!! #crisisofconfidence #bitcoin #tether #crypto

Tether Loses $1 Peg, Bitcoin Drops to 2020 Levels of Near $24K

www-coindesk-com.cdn.ampproject.org •

William Nash• 3rd+Demystifying Fund Marketing @ Edgefolio •

Over the past 48 hours in crypto it’s all been a little hectic. A mixture of genuinely unprecedented events and normal market turbulence has led to a great number of news stories about crypto, coinbase, btc, LUNA etc. I speak with great crypto funds all the time – and wanted to quickly share their perspective over the past two days.

Firstly, fundamentals haven’t changed. All coins, and all stable coins are somewhat vulnerable to sophisticated attacks. Everyone knowledgeable in crypto knows that these types of long tail risks exist – and this hasn’t changed. Nobody is packing their bags because of this.

Secondly, crypto is still very very young. The fact that some genuinely brilliant journalistic outlets don’t understand crypto or defi is a sign that we’re still nowhere near to saturation.

Lastly, good processes and good systems are the most important thing in moments like this. It’s super noticeable that people with good risk management, strong systems and tools have been much much calmer. For them, this is the typical come and go of the market and they’re still focusing on their goals. #crypto

Rana Bhattacharjee• 3rd+Portfolio Manager | AI/ML consultant | Finance and Technology Trainer •

Unbelievable volatility in one of top 10 coins/stable-coins recently. Keeping aside what happens to Terra Luna eventually or the future potential of crypto-currencies, from a financial investment perspective, this only goes on to reinvestment the age-old risk diversification principles.

1) Do not look at returns on a absolute basis. Always look at it relative to the amount of risk you are taking, risk being measured in terms of volatility. So in this example, one can very well imagine, what would be annualized volatility of an asset that can crash 98% in one day.

2) However good the projected return, do not put all eggs in one asset or even one asset class. Diversification can reduce the pain significantly.

3) Diversification should be among assets with low correlation. So investing in a ‘diversified portfolio’ of crypto currencies, is not achieving true diversification as all of them could go down together.

#investing #riskmanagement #diversification

Terra Luna cryptocurrency collapses 98%, investors lose life savings

Manoj Sugathan• 3rd+Head of Contactless & Urban Mobility Programs6h • 6 hours agoFollow

10 things I learnt from the ongoing Crypto Crash:

1. I am not smart enough to understand these complex crypto solutions. Neither are many of the founders of these Crypto solutions

2. You cannot create/mine/mint money out of thin air unless you are a government and has the military might to go along with it

3. On the way down, BTC and crypto’s looks like NASDAQ on steroids

4. Janet Yellen is more powerful than Do Kwon

5. SEC is more powerful than Terraform labs

6. After UST fiasco, regulators have no choice other than to come after other stable coins. USDT will be in the cross hairs next. And the outcome may not be pretty when the details of the commercial papers backing it comes out

7. Though BTC may be logically sound, if the pillars that holds it up like UST and USDT gets impacted, BTC can go a long way down

8. The last 2 days have been a great learning experience – nothing like real world flashing reds on computer screens

9. I think there are lot more lessons to be learnt in the coming days and we all need to start thinking more logically than getting carried away with exotic ideas

10. I am not smart enough to understand these complex crypto solutions. Neither are many of the founders of these Crypto solutions

#crypto #bitcoin #cryptocrash

If only there was a form of governance…

Maybe a central entity of some sort…

Wait a min…#stablecoin #terra #luna #defi #monetarypolicy #crypto

Aman Verjee, CFA• 2nd Founder / General Partner at Practical Venture Capital •

Interesting story emerging about TerraUSD, an algorithmic stablecoin that seeks to maintain its value of 1:1 with the US dollar … a « peg. »

It does this with a complex combination of code, trader incentives, some smart contracts, and by working with a crypto token in the same ecosystem (Luna) which can be swapped for UST and vice versa by traders to keep the price of UST where it should be. A-list investors, a dollar peg, 15-20% « risk free yields, » all seemed like a crypto dream.

Only now it has come undone with stunning speed. A week ago, the future looked bright. On Monday, all of the mechanisms that were supposed to keep UST stable didn’t … it fell to a low of 60 cents. On Wednesday it crashed to 20 cents. They are now attempting to raise $1.5 billion from new and old investors alike to provide more collateral to UST, hoping to rebuild the token’s liquidity after it virtually disappeared from order books overnight.

Exactly why all of Terra’s carefully-planned mechanisms failed to do their job remains unclear. Let’s see if the peg holds.

#Luna #crypto #cryptocurrencies

‘Everything Broke’: Terra Goes From DeFi Darling to Death Spiral

Aya Kantorovich• 3rd+Head of Institutional Coverage at FalconX •

Thank you, Emily Chang & Bloomberg LP, for having me on to discuss what happened with #UST, Luna’s algorithmic stablecoin, this weekend into this week.

UST is an algorithmic stablecoin that depends on a mint & burn function between LUNA and UST when the value of UST goes above or below its 1:1 ratio. Every time $1 worth of UST token is bought, $1 worth of LUNA is burned, and vice versa.

The Terra team has also launched a number of applications, most notably, Anchor Protocol – which supplied a 20% yield on UST deposits to the pool. This pool hit $17bn in total value locked on Monday at its peak and consisted of money from every persona: retail, protocol treasuries, crypto native, traditional asset managers, venture funds, hedge funds, etc.

This weekend, a motivated seller sold a significant amount of UST, de-pegging the algorithm. Why does this matter?

Loss of confidence in UST triggered a bank run which applied further downward pressure on the price of UST. UST is redeemable for $1 Luna up to a certain daily cap after which slippage increases. That cap was hit very quickly. The only alternative exit in DeFi is a liquidity pool on Curve. It contained $1bn of liquidity and got depleted by Monday morning.

Anchor went from $17bn in total value locked to $2bn today, with majority of folks rushing to pull out UST from the pull and convert to USDC or dollars as the peg saw lows of $0.3 today.

What does this mean for algorithm stablecoins? All eyes on Frax, and TRON’s stablecoin, to see how these token fundamentals react to volatile markets.

The Role of Algorithmic Stablecoins in Crypto

Some bumps in the road are unavoidable with the pace of crypto development. The failure of TerraUSD’s peg to the dollar (and the crash of UST and LUNA) is a big one. Coinbase has shaken both investors and users with the news that accounts would be considered unsecured creditors in the event of bankruptcy. Ultimately it’s a reminder that the path forward (or upward) is not always going to be a straight line (or a hockey stick). Digital assets, DeFi, Web3, etc. will be the future but not everyone is going to come out as a winner.

#cryptocurrency #stablecoin #terra #ust #luna #bitcoin #coinbase #digitalassets #defi #web3 #crypto

Trey Sellers• 3rd+Vice President, Client Solutions at Unchained Capital1d • 1 day agoFollow

#Bitcoin and #crypto are two completely different things. Bitcoin is decentralized money that can’t be manipulated; cryptos are decentralized in name only (DINO) and exist on a spectrum of misguided/infeasible to outright scam. Unfortunately, this can be an expensive lesson for some people to learn.

Luna Nosedives Under $2, Loses 98% Of Its Value As TerraUSD Struggles To Regain Its Dollar Peg

Gopal K.• 3rd+PhD Student at Harvard University •

With 7.5% inflation, you will lose half your money in 9 years. Crypto, I have discovered, is the only way to consistently outperform that. I have already lost half my money this year.

(from https://lnkd.in/egR9VTtb)

Krisztián Sándor• 3rd+Fulbright Fellow of Business & Economics Reporting at New York University •

My latest story on the biggest implosion in crypto in years: